• Ensure that your data is always consistent, accurate, verifiable and up-to-date.

• Access clear, structured data whenever you need it.

• Deliver critical information to the right people at the right time.

• Adopt a single solution that eliminates overlapping, redundant tools and systems.

• Gain a complete, integrated view of all enterprise data.

Data that’s Consistent, Accurate, Verifiable and Up-to-Date Access the data you need whenever and wherever you need to – and be confident in the validity and timeliness of that data. A banking data model lets you correct, stan¬dardize and verify data to provide accurate, up-to-date business intelligence and meet regulatory reporting requirements. You can also acquire and consolidate historical data from both internal and external sources for use in analysis and reporting.

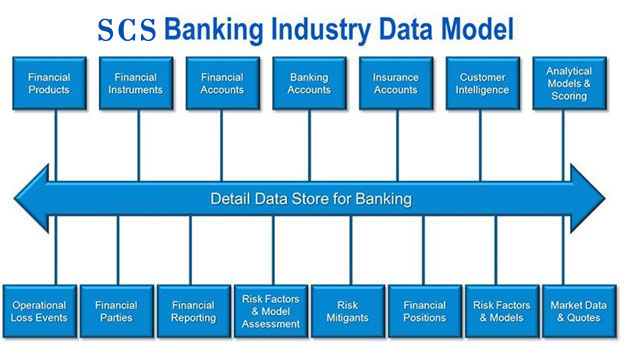

A Complete, Integrated View of All Your Enterprise Data A comprehensive data dictionary covers all key banking subject areas, including marketing, finance, risk and compliance across consumer and corporate banking, mortgage lending, wealth management and investment banking.

Clear, Structured Information for All Who Need It

Easy-to-use, web-based reporting makes it easy to communicate critical business infor¬mation to the right people within your insti¬tution. Comprehensive business intelligence capabilities meet the needs of every type of user, including:

• Managers looking for dashboards.

• Groups that want to view and build reports on the web.

• Business analysts who need advanced data exploration software.

• IT staff members who need to deploy, manage, control and maintain the solution.

No More Overlapping, Redundant Tools and Systems The flexible, reliable Banking Analytics Architecture is a complete solution that supports all your data integration and reporting needs. It eliminates the piecemeal approach of linking and managing technol¬ogies from different vendors. It also lowers your overall costs, reduces risk and enables faster results.

A comprehensive data model serves as a single version of the truth for an enterprise data warehouse that covers all key banking areas. The framework supports consumer and corpo¬rate banking, mortgage lending, wealth management and investment banking, and has the flexibility to extend to new lines of business. It also includes:

Find out more about how we can help your organization navigate its next. Let us know your areas of interest so that we can services you better.